New residential construction and lumber prices share an intimate relationship.

A major cause of today’s inventory shortage is the underproduction of new-construction homes over the previous 13 years. This underproduction was further exacerbated over the last year by material shortages and rising costs of lumber, due to Covid-19 supply chain impacts.

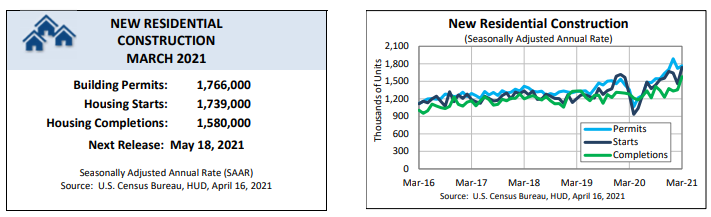

The U.S. Census Bureau recently reported that new-home construction has surged after a winter shut down, with March’s figure of 1.74 million housing starts marking the highest in 14 years. This is a 37% increase from March of 2020. This figure includes both single-family units and multifamily units.

The largest gains in new construction are in the Midwest. The South and Northeast are also seeing increases in new-home construction, though new-construction activity is slowing in the West.

To add to the good news, the pace of permitting for new homes is also on an upward climb, up 2.7% in March from February and 30% from March 2020. Permits for duplexes, triplexes, and quadplexes surged by 25.5%, though authorizations for multifamily developments in general dropped by 4%.

Housing completion typically takes 4 to 8 months and an improvement in available inventory is on the horizon. But one must ask next – With the cost of lumber being what it is, what does this mean for affordability?

View the report: U.S Census Bureau and the U.S. Department of Housing and Urban Development MONTHLY NEW RESIDENTIAL CONSTRUCTION, MARCH 2021

Join 5000+ professionals in the real estate and finance space talking trends and data: Estate Professionals Mastermind

New residential construction trends August 2022

Update August 16, 2022: New housing starts have fallen to the lowest levels since July 2001, according to Bloomberg.

“Residential starts dropped by nearly 10% last month to a 1.45 million annualized rate from a revised 1.6 million pace in June, the government data showed. Applications to build, a proxy for future construction, declined 1.3% to 1.67 million.

Prices for commodities like lumber have eased in recent months, though builders continue to struggle to fill open positions, especially more skilled roles. Two-thirds of construction firms reported few or no qualified applicants in a July survey of small businesses. “

-BloomberG