How to Calculate ARV and Repair Costs for Maximum Allowable Offer; Nurturing B2B Referral Relationships; and 3 Ways To Handle Probate Property Clean Outs: Probate Real Estate Coaching #22

Episode #22 of Estate Professionals Mastermind Podcast

Join the Estate Professionals Mastermind group for weekly group challenges, high-energy community support, and bite-sized content.

Calculating Maximum Allowable Offer, repair costs, and more with live Q&A

Chad, Katt, and the Masterminds brainstorm tips, strategies, and tools for working less, earning more, and doing good. Chad kicks off the call by sharing his Back-Of-The-Napkin formula for calculating max allowable offers (MAO) and presenting those offers for wholesale and investment. The masterminds then brainstorm tips for leveraging vendor partnerships to help pay for upfront costs either through invoicing, liens, or simple interest on owed balances. Chad and John discuss tips for nurturing B2B relationships and which vendor partners are the best to pursue. Chad, Rodger, and Alex brainstorm ways to help move two trustee listings forward to sale as the siblings continue to infight and procrastinate, getting in the way of necessary cleanup for staging and showing.

THIS WEEK’S CHALLENGE: Probate Mastery’s top performers are challenged to continue progressing in their video marketing efforts and complete the Probate FAQs Video Prompt Challenge.

Episode Time Stamps (YouTube Links):

0:00 How to Calculate Your Max Allowable Offer: ARV, Repair Costs, and Your Target Profit

4:25 The 70% Rule in 60 Seconds: The Back Of The Napkin Method

9:06 How to Estimate Repair Value and Learn Your Cosmetic vs. Mechanical Repairs per Square Foot

15:06 What is an Application to Relieve the Estate From Administration?

15:36 How to Offer Free Services Without Expending Your Own Capital

17:12 Costs of Probate Services: How to Turn Vendor Partners into Your Bank

19:12 How to Target the Right Attorneys for Referral Relationships

27:24 Nurturing Vendor Relationships and Generating Real Estate Referrals

35:18 Transaction Engineering: Three Ways to Handle Personal Property Cleanouts

Resources:

- Join Estate Professionals Mastermind Group (Facebook)

- Check out Estate Professionals Mastermind and More on YouTube

- 18 Prompts for YouTube Videos that will Jumpstart your Probate Real Estate Marketing

- Recommended Marketing Books: Probate Mastery Reading List

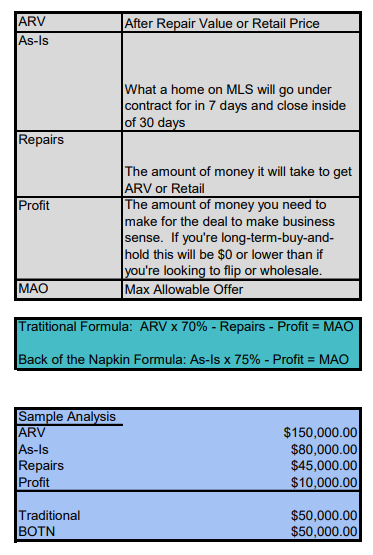

- Formulas for Calculating Maximum Allowable Offer (MAO):

TRAINING SEGMENT TRANSCRIPTS: (Download PDF of Full Transcript)

How to Calculate MAXIMUM ALLOWABLE OFFER (MAO) for Wholesaling and Investing

Let’s start with getting to your maximum allowable offer or a wholesale offer. And David, now I’m happy to see you here, brother. I think you might jump in on this too, and it’s all kind of show you the way I learned the way ever at most. Everyone else does it. And then the way that I started doing it, and I prefer what I call the back of the napkin method, especially in this environment with fluctuating construction prices, like if you’re wholesaling or if you’re flipping to nail that, you have to have a pretty deep understanding. If you’re going to use the traditional model, you have to have a pretty deep understanding of construction costs.

And that’s one of the hardest things to learn, especially in a dynamic environment where lumber is swinging three to 400% and you’ve got manufactured woods that have dropped down and come back to a realistic market price where lumbers still has as finished lumber has. So I thought we would start there, let me I’ll share my screen.

So the gray box is just definitions. So for anyone who might be new to this conversation, when we talk about ARV, we’re talking about after repair value.

Most beautiful conditions sitting on MLS, looking for a retail end buyer. That’s our ARV. As is, and this is a personal definition for me, but as it is valuable to me, if I put this home on MLS right now, What is a price where I can all but guarantee I have a ratified contract with no contingencies in seven days and closing inside of 30 days, basically a wholetail, right?

We can put it on MLS, get a buzz from cash buyers. And in this environment with such an inventory shortage, that price is higher than ever. Repairs like estimating repairs, it’s simply just the total gross amount of money that needs to go into the property to get that top ARV or retail that, yeah.

Profit is what you want to make on the deal. So some people are willing to tolerate $5,000 a deal and we’ll flip it razor-thin margins. There’s a reason iBuyers came out of the gate in a downward price race. Their models are built on razor-thin margins. So if you want to chase your tail, go do deals for five grand.

But I would recommend you move up the scale. It didn’t make sense for me to do a deal if I couldn’t make 18%. Now, if you’re wholesaling and you’re not risking capital, if you know your marketing expenses, you should be able to determine a palatable ROI.

Because if you’re going to assign the contract, you have no real basis and the investment. Anyway, it’s your investment in your marketing and payroll. So look at that and say, okay, what is my basis per deal? How much money do I spend per deal to get these deals and how much do I need to make in return? So rather than having a cost basis on an asset, like in the asset itself, if you’re wholesaling, your cost basis is going into what it takes to run the marketing machine.

So if you’re spending $5,000 in marketing and payroll to get each deal, you know, damn well better, be making more than five grand. And if you’re a long-term buyer, hold this, this number could be zero. You don’t have to add in additional profit because you’re going to be looking at EBITDA on your internal rate of return over time.

So your particular tax situation comes into your return and your profitability. Your particular construction costs and your management, the way you meant it, what your management agreement is you self-manage. So this is more for the fix and flip long-term buy and hold, or just straight up wholesale or excuse me, straight up wholesale, but not as much for the long-term buy and hold.

You’re going to value. You’re going to look at retiring a little differently if you’re a portfolio holder and then your MAO is your maximum allowable offer. So I put these definitions here because this is what’s been taught for 40 years. If you’ve ever followed any of your old-school investment coaches.

The 70% Rule in 60 Seconds: The Back Of The Napkin Method

So your traditional formula is your ARV or retail price times 70%. Minus repairs minus profit equals your max allowable offer. Whereas I see almost every person that’s new to investing get hung up and where I got hung up. And the first thing I did when I started wholesaling is I went to a home show. I met a contractor, met a realtor, and I walked through, I picked three houses and I said, I’m not going to buy these houses.

But we’re going to go through these houses. I’m going to give you a scope of work. You’re going to give me a line item, quote, directly from QuickBooks, with your price per unit. And then I’m going to come up with the maximum allowable offer that I would give. And then I’ll track this house all the way through and see if I can do this.

It took me about two weeks to do all that. And what ended up happening is I laid down an internal knowledge of construction cost and Roanoke, Virginia, because I was coming from Kaanapali Maui and our costs were exorbitantly higher than what they were in a small town in Virginia. So it took me a couple of weeks and a hell of a lot of effort to really kind of get to where I trusted my damn offer.

And I see a lot of people struggle with this. A lot of people have to go back and renegotiate prices a lot. Like they leave money on the table. And so if you don’t have a good handle on construction costs, it’s easier for me to teach you a different formula than it is. But recently the insurance industry has started to data. Normally they aggregate that share between insurance companies. So if a hurricane blows through Florida, they all have a central database where they know that they’re not getting ripped off, which will allow you to plug into. I need a full bathroom to remodel, a full kitchen remodels, a driveway re-seal or a roof replacement, and zip code 2 40 0 1 9. And it will go out and look over the last month of the actual envelope pay to bring back those true costs. There are tools out there but at the end of the day, if you’re risking real capital, do you trust an app? Like that data is garbage in garbage out, it’s better if you know y cost. So rather than going out, building a relationship with a contractor, trying to get all of his pricing out of, out of his QuickBooks and line item quotes and studying these and staying up till four in the morning and spending weeks get getting to where you trust your offers as I did, you can just use a simpler formula. So this formula was taught to me by a gentleman who owns one of the largest real estate investors, direct mail companies, and then the country. And it was when I was, I had the spreadsheets like I was analyzing every number, trying to trust my offers. Right.

He’s like, dude, you just like, I’ve been using this one for 20 years. And it’s simply the as-is value. So what, what if we put this house on MLS today? How quickly, you know, what can we guarantee? We get a contingent fee contract at seven days, closing 30, that price times 75%, minus whatever profit. If you’re looking at it from that standpoint is your max level offer.

Now I took some simple points and this is from a real deal that I underwrote this way. I had an ARV of one 50. I had a wholesaler. I could, I could buy it at 80,000. The market would support 80,000. If he would have thrown it on the MLS, it needed about 45,000 in repairs. I wanted to make about 10 grand.

And you see, I don’t know, this probably doesn’t translate too well in a live zoom, but you can see the formula that I used here matches the formulas that I have up above. And we’ll try to pull this into a PDF that you can download in the show notes here, something that’s a little more usable and understandable.

So, anyway, we’ve had questions about this, and I wanted to start the conversation by first showing you there are two ways, in my opinion, you’ve got the traditional way, which requires you to have a much higher skill set and leaves a lot for our room for you to make mistakes.

If you underestimate repairs, and then you got basically, here’s what I know the market would pay for it. I’m going to discount that by 25%, I’m going to discount that by the money I want to make it. And that’s what they offer. And what I found is when I would make my big complicated spreadsheet and have every single variable in there, and then I would throw the simple offer up beside it. I would usually land within a one to 2% on my offer price. So that’s when I started doing the back of the napkin methodology. And this is, I have a similar methodology, like for full-blown apartment buildings.

We can go walk the 110 unit apartment building and make a confident offer and on the spot because we have more back-of-the-napkin tactics. So there’s a lot, a lot, a lot of stuff out here about this, but it doesn’t have to be as complicated as I think as, as a lot of people perceive it or, some other, you know, professionals or gurus might make it.

How to Estimate Repair Value and Learn Your Cosmetic vs. Mechanical Repairs per Square Foot

So I’m going to stop the screen share. We’ll go back. We have a conversation about it. I want to know and hear how you value your maximum allowable offers. And if you agree with what I said or disagree with them, And for those of you that don’t know, David, if you’re just getting introduced, David is a broker as well as an investor doing about 60% of his deals as an investor now, because he found out he could do the same amount of work or excuse me, a lot less work and make a heck of a lot more net profit.

Yeah. I mean, that’s just, it takes that experience of knowing what to look for in a house. And sometimes I get it to spot on. Sometimes I’m a little bit off like you said, and sometimes I’m a lot off, but especially this one I’m working on now, but they all seem to, I don’t go by a calculation, more looking at it.

I just assume that these are $35,000 worth of repairs now. If it’s cosmetic and there’s a few things I’m looking for, big items, your AC unit, foundation, and electrical plumbing is one.

You know, AC is somewhere between 3500 and 6500; electrical is like three to three and a half dollars per foot. So that gives me about $20,000 worth of major items and $15,000 of cosmetic stuff for painting fixtures little stuff, but it all adjusts, but I get pretty darn close on a 35 thousand dollar offer unless the house is just really bad shape. Like I started out getting like exact, I wanted to, I wanted to have line items, you know, everything like here’s what I think it will cost. Before I switched to the back of the napkin methodology, the next step was to make it a little easier on myself.

As I took three or four or five deals I’d underwritten and worked with contractors and gotten actual quotes. And then I figured out I had three classes of rehab. I had buy-and-hold level of rehab, which is, you know, it’s basically in stock, builder, grade, everything from Lowe’s. Then there was a middle-market retail rehab, and then there was a high-end retail rehab actually in, in the middle market, that’s where I did pretty much all my deals. So I had basically your cosmetic rehab price and then a full, like a heavy construction price. And what I got down to is you could take the footprint of the house. And for our cosmetic rehab for paint carpet, paint, carpet, new doors on the cabinets, reusing the boxes, popping the countertops off, putting back new countertops, refinishing, hardwood, floors just refreshing the house, cosmetic rehab, all new switch plates, all new doorknobs.

Just cosmetic things, I could get pretty damn close with a conservative estimate at $15 a square foot, but where that breaks down as a national speaker here is your market’s going to be way different than mine. And it’s hard for me to teach that rule of thumb. But I had in my market when I built the detailed construction knowledge, I knew that I could do a cosmetic rehab for 15 bucks a square in a middle-market flip.

And I knew that if I had to do mechanicals roof furnace, roof, HVAC electrical foundation, the complete outlier, I spent $135,000 on one single foundation. If you’re getting it done as warranty work, it can vary from, I’ve seen it never seen one less than 15,000 with a warranty, and I’ve had them up into the six digits.

There’s a cool case study on that from Ram Jack that I did the case study for Ram Jack, but so you can sometimes work it into a rule of thumb like that, like 15 bucks a square foot for cosmetic 30 bucks, a square foot for heavy construct. And that worked pretty well for me, but with fluctuating construction costs, that makes me hesitant to tell you guys to go use rules of thumb, because you’ll be like you said 30 bucks a square foot, I’m 50 grand under, right?

Yeah. So that’s why I like the back of the napkin. Let the market speak. The market will tell you your as-is value discount that about 25% and then discount that by your profit and your margins in there, or your PR your price, your price includes construction. And you’re. And just to take one of those big items like foundation you can call a couple of guys that are we have one guy that will do piers for $150 a hole.

So what I mean by hole, they dig the most expensive thing on foundation work is digging the hole, not putting the piers in. So it’s one 50 for us here and every four feet that we need a pier so if I know a house looks to be, I’m just guessing when I’m in a house, but it feels like it’s sloping down in a certain area of the house in the corner.

I know that it’s probably sloping down an inch and a half, maybe two inches. You can tell if it’s three or four and that’s bad. Cause you’ll see cracking everywhere on that exterior wall. But if it’s an enter inch and a half and you need piers every four feet, so you walk the outside of the exterior of the house, you got 20 feet and need four piers and add one.

So you have about $1,500 in foundation work. I’ve done a house where I’ve done a house in 81 peers. I’ve had a big boy like you. We did the whole exterior of a house and I was $55,000 in foundation work. Did that include a lifetime transferable warranty? That one did. I have a good guy. I mean, he’s done foundation work for years, but he won’t warranty anything, but I can bring him in at a 10th of the price of Ram Jack, but for the gram Jack, we’re using a hundred-year epoxy coated Haley called piers that are driven down to I to forget the refusal point 15,000 PSI.

Think. Or, or foot-pounds, and then they’re offering a lifetime transferable warranty for whoever, you know, no matter how many times So anyway, but that’s one of, that’s a good example of an outlier. There are overlooking things, and then there’s just not understanding how much things cost.

Right. But either way, I like the back of the napkin formula because you’re less likely to make mistakes and have to go back to renegotiate a deal with egg on your face.

It’s asking those contractors how they price things. And eventually, you learn what to look out for and you don’t need them there, especially if you know, a middle to ground person, not a real high professional or somebody who’s just watched a video on YouTube and decided they wanted to be a contractor.

So, yup.

What is an Application to Relieve the Estate From Administration?

Balcom, I see you have your hand up brother.

Oh, yeah. Let me see. I had a couple of questions. So the first one, I, I’m seeing a lot with some of these fresher cases where the docket says that there’s an application to relieve the estate from the administration. Now it wasn’t really clear what that was. So I figured out what it is. What state are you in?

Ohio. It sounds like maybe probate wasn’t necessary. So they’re rolling it back because they were exempt. Okay.

How to Offer Free Services Without Expending Your Capital

Okay. And then the second question.

As if it was it’s in regards to the services by so, no, basically we’re telling people that we have these free services that we offer, which to a large degree is true.

The question is, is that okay, let’s say that the property needs landscaping because they’re in an area where if the grass gets to go it gets too tall. They’re going to get cold, right? So by us telling them no that we have the services that we want. Who’s going to pay for the landscaper to come out there and trim that grass?

Is it going to come out of the cost? Like, is it going to be rolled into the holding costs of the PR, or exactly where is it? Well, it depends on where they are in the process, if they, you know, and typically when we make contact, they, you know, the death occurred a couple of months ago. That’s just typical behavior is they’ll file probate.

Usually 60, 70 days from the date of death, there are outliers on both sides of that. Some people wait 10 years and some go the next day. But for the most part, what I’ve observed is it takes people a couple of months to kind of process this to the point where they go to the courthouse and figure out what the probate process is and what they’re going to need to do. In that time usually, the probate Clark will give them enough information that they can go to the bank and use the documents they get. If it’s a simple estate, they can just have an affidavit of heirship or they can have letters testamentary, but if they already have control of the bank account, then ideally your vendor gets paid directly from the estate.

If they, if they’re very early in the process. So that’s a very urgent situation. Yeah, you can have the representative pay for it out of pocket. And then they can be reimbursed by invoicing the estate. And they’ll be reimbursed in the final accounting.

Now, if there’s no money in the estate’s bank account, and the PR has no money, which you will find, these situations, are where having real vendor relationships come in. Because as crazy as that might sound, you can turn a lawnmower into a bank. If you take a guy and say, listen, I need you to do this job and I need you to keep this thing cut. Keep an invoice, submit it here to this address, have him invoice the court, I have an invoice the PR, and have them carry a 10% premium on the invoice.

Costs of Probate Services: How to Turn Vendor Partners into Your Bank

So there’s an incentive for him to dip into this, but we can turn our contractors, our landscape companies, anyone, we can have them earn a fair interest rate for carrying the invoice for 90 days until there is cash that you generate through liquidating personal property or real property or otherwise. So that’s kind of the three ways that you get things paid for.

There are very rare occasions where I have come out of pocket and covered costs. It’s usually when I have, I know there’s tons of equity in the estate, there are more assets than there are liabilities. And usually, it’s with really elderly people that very very deeply trust me, but they don’t trust the vendors because they trust me so much. If that makes sense. I’ve had some folks that are in their eighties and nineties and surprisingly, they were probating their parents’ estate. It’s not, they’re not their siblings. And I mean, there was one lady who was 94. And I mean, her mother had her very young, but she was probating her mom’s estate in her nineties. I’m like holy smokes. But she just, she thought the world of me that she wouldn’t trust my, my trash out guy. She wouldn’t trust my floor guy. So I paid for everything. I had it all trashed out, put all new flooring back in and she drove two and a half hours to come to bring me a check the next day.

And every once in a while, I’ll stick my neck out and I’ll take that risk myself, but I don’t recommend you make a habit of it because the service you’re providing is so valuable. You don’t need to be a free bank and take financial risks when you’re, you’re already quarterbacking for them.

How to Target the Right Attorneys for Referral Relationships

Okay. And last question. I see we’ve got John in here, so this one’s going to be directed at both of you. So reached out to a gang of attorneys. You know, since the last time we had that conversation, I went after the big guns and I didn’t, you know, I didn’t care. They’re small owners so it was just like any business.

So I know I went out of them had pretty good results. I’ve had some meetings set up. Unfortunately one of the ones I was going for was a little bit too busy. So I built a program that parses the Ohio bar associations website filters down on, based on attorneys that are in the state. So I’ve got one and I checked her in the court database.

I don’t see her name anywhere, but she seems like she would be extremely approachable. Would you advise, you know, targeting her and building that relationship because she doesn’t, at least as far as you know, the court database I have, she hasn’t had any cases?

Did you go after her or would you just stick to going after the big guns?

My, my, my wheels are turning. I want to talk about the program you wrote about. If you walk in John’s Fraker’s office and say, Hey, would you like to see how your competition’s doing? And hand him the list, he’s going to say, yeah, come on in, come on in, sit down. It’s pretty cool. That’s amazing. I do think John, you’re the best person to answer that.

Yeah. I mean, it’s all. And I’ve had, I’ve had this conversation with a couple of the different members, Renee. And I talked about this at length, right? So some attorneys are going to be too busy to give you many referrals. Some of them may already have their people dialed in. You know, I told her, Hey, I had a case it was like 2007.

I think it was, it was a partition action. Where a dad died and left the house too. Or the parents died and left their house to their five kids, 20% each on the deed. And they couldn’t agree on anything. And my client was in San Jose, the properties in LA, and they got all their requests for an accounting and all that stuff was around filed.

So they finally, after two years of getting the phone slammed on them, they went to court and at the end of the process, which is kind of a, I mean, it’s a huge waste of time and money because you can’t stop. In other words, my client was going to prevail and get exactly what he wanted, because this is what the law gives him at the end of the process, their attorney who likes completely botched everything on their behalf, the whole way through I enjoyed making him look bad to his clients at the end of that process.

He was like, oh, I agree to the settlement. If we can use me if we can use my realtor. And this was before I did real estate and went back to my business partner, Leon, and he said, he’s like, something is going on there where that guy is getting some kind of business kickback or something. It’s. And it violates the state bar, but Leon’s is just completely convinced you couldn’t talk him out of it, that, that wasn’t going on in that case and many others.

So when you’re talking to super successful attorneys in certain spaces, you want to know what their capacity is to take on new referral sources. They may already have their people dialed in. They may already have that relationship. So being able to talk to somebody on the new end, helping them expand their business carries more bang for them.

I guess it’s a little bit of a longer-term deal, right? If you’re talking to somebody who’s out of law school, two years is just getting started. They may not have a lot of business, but if you’re helping them, they’re going to remember that along the way. You’re going to be building Goodwill with them.

You’re going to get in there and build that strong relationship from the get-go. So like with Renee, I even I’m like attorneys three to five years out, or three to five years in this practice is your sweet spot going after somebody who’s been doing this 20, 25 years, they have their people. Yeah, that’s what I ran into with one of the guys I called him, you know, cause after I had the pep talk, I talked to coach Jay.

I said, all right, well, I don’t care how much business you do have up here. How many times I see your name I’m going after? So, I was aggressive. You know, some people, you know, they were receptive to it. Unfortunately one of the guys I was talking to, he was wanting to control bait himself because it’s a relative, just that he’s a probate attorney himself.

So I’m actually, the cobbler’s son has no shoes. Yeah, it was, it was something, it was something. So I’ve got that appointment set this week, but I just didn’t want to sit on my hands and wait, especially now that I’ve got this other attorney where seemingly she’s done no work, something like, you know what, she’ll be much more receptive to here.

Oh, the things that I’ve got, I’ve got to say but I was just, you know, I was curious to see what, you know, what you thought, Chad, in terms of sticking to the big guns and going after the person, that’s not, you’ve got a, you’ve got unusual, I don’t know if it’s unusual, you’ve gained a very unique skill set. A lot of folks on here can’t write their programs to do this, but so this is pretty much directed at you. Something that John said kind of spurred a memory for me. Like attorneys can take kickbacks as long as they’re licensed real estate brokers, and it may not be legal, but I know of attorneys in California who rev recruited my students and our customers.

Tried to recruit them by saying, I’ll give you my deal if you’re giving me a 25% referral. So if that attorney has a bar license and also has a real estate license, don’t waste your damn time. So in your program, like if you’re programmatically extracting the, like, if you want to focus your efforts, I’m not going to say never.

You can go unseat them and say, I’ll give you a 10% referral, not 25, but if you want to make your program a little bit better, Make sure that you do, you deduce the people from the attorneys, from the list who also have a broker’s license and the same state, because that way you’re, you’re less likely to come up against ones who are looking for, to trim, trim your commission, or they already have established brokerage relationships in place.

And that they’re getting 25% referrals. It may just save you some more time and help you cut that list down. Now, as far as methodology. Yeah. When I the way you’re looking at this as, as similar to the way I look at financial services, when I look for a true financial service professional, when I know that parade is principle is present on 80% of the industry, isn’t worth the shit.

They’re just chasing commissions and they don’t care if they’re, they don’t, they don’t, they don’t see themselves as your fiduciary. And they’re not. I only look at registered investment advisors because they have a fiduciary relationship for every single client, whether it’s a retirement account or a taxable account.

So that makes me narrow down that way by saying, I’m looking for a higher standard of professionalism and a true fiduciary responsibility. Then I look at and this is you can get all those data from FINRA. If you haven’t already, if if you want to do this, but financial advisors, there are amazing databases.

Brokerage information and individual information. Like you can see in their book. What I’m looking for, just like in real estate financial services has that, that three-year mark, like there’s, there’s an 80% plus failure rate in the first three years. If you can get past that three years and you probably are pretty good at what you do.

If you get past the three-year mark and you got over a million dollars in your book, but under $10 million, Got money to survive and you did, but you’re probably hungry as hell. Right? So when I go to look for a financial service professional that I trust, we’ll have a fiduciary that will see himself as a true fiduciary with my clients.

And he will go above and beyond to not just sell high commission bullshit products. Like that’s how I underwrite and look for that person. That’s how I filter. So. And are they registered investment advisors? And did they accomplish that in their first three years of business? They’re still in the business.

Are they between one and one $10 million or whatever? You can figure out what the number is in your market and a higher net worth market. It might be a hundred nights. That’s the way I look at it and I don’t look for the top tier and the beginning, I’ll look for the hungriest person with the highest professional credentials in the beginning, and then I’ll build from there.

And just like John said, you help those people. You’re going to build allegiance. Like you’ll, you’ll build loyal, loyal, lasting relationships, and they’ll reciprocate quickly. That’s awesome. Yeah. I a shameless plug, but I built the program for James Dempsey. He’s a number one. So he’s got the entire state of Georgia automated.

Now every single account. Yeah, I think you and I should take a look at that. I can see a few applications for the group where we might build up pretty damn cool toys. Okay. Well, that was all I had. I appreciate it. I’m going to call the bed. I’m going to call the attorney to get out. Okay. Well, cool.

Thanks for sharing, man.

Nurturing Vendor Relationships and Generating Real Estate Referrals

Bill, looks like you’ve got a hand up.

Questions in the chat too.

he said I would like to hear your thoughts about following through with referral sources. How do you gain their attention after initial contact? Basically? Like what we were just talking about, find ways to provide value to their business. Hey Bill, you have a microphone.

Yes, sir. How’s that? Yeah. So you want to know how to keep the relationship going with vendors, right? Like how do you stay front of mind? I’d been on, I probably talked to 20 attorneys and a dozen CPAs and ancillary different types of people. I’ve got some basic, pretty good connections, but nothing established well yet.

So I want to be able to go back and continue to nurture that type of relationship. The recipe is the same, regardless of which team member it is, bring them business, bring them referrals. The ingredients are different, depending on the business, like if it’s a contractor, get him some jobs, give him some simple inspection repair work to do where he can knock out three grand in an afternoon to clear a home inspection, on, especially if it’s crappy weather outside, give him, give him inside work. When it, when the weather is shitty outside, give him outside of work when the weather’s nice outside, like, just think about him. Like, if I was him, what, what kind of work would I want to get there?

And what kind of referrals. If it’s a CPA, find some high net worth individuals that aren’t happy with their, their effective tax rate and have those conversations be like, Hey, I’ve got an amazing CPA. He’s got my effective tax rate down to 20 percent, what’d you play last year? And like be in an environment where you can find people who aren’t happy.

They’re like, oh, I paid so much in taxes. Maybe you should sit down with my guy. He’ll do a free consultation and help you understand where you could be saving and whatever that is, whether it’s a state cell company or it’s an attorney or it’s a CPA, or a registered investment. Think about what are the best referral I can give this person and how can I put myself in a position to be the one that has the opportunity to give him that?

You know, one of the examples we talk about most often is with estate planning attorneys, we find high net worth individuals who don’t have a proper estate plan in place. And we encourage them to take a free hour of our advisors’ time And then we go find the advisor or we feed the one we’ve already found when they’re happy to give an hour of their time because they’re likely to earn a considerable amount of revenue on that business.

And if they do a good job, they’re likely to get referred to other people by that. No, it’s not that you’re stacking up a bunch of social debts by having them spend time with your referrals. It’s quite the opposite. You’re building social capital. So let’s just say we have 15 to 20 critical team members that would help in any given year. You don’t use them all on every deal, for sure. Just when you get a chance kick some business their way and help and make it a good referral. Let’s just say it’s a lender and you need a guy that can quickly help get your investors financed on residential deals. Don’t send them some first-time homebuyer with a six 19 credit score. Like, send that to a different lender. If that relationship’s really important to you, because he’s going to be like, what the hell Bill? Like it, there’s no way, you know, this, this guy’s never making it through underwriting, but if you send them, you send them the doctor that just signed an employment contract for $300,000 a year. Doesn’t have a down payment, but as an 800 credit score and they’ve got their employment contract, he can get that one financed. He’ll portfolio that one, he’ll close it quickly and he’ll make more, more money on it because it’s a portfolio loan.

That’s the kind of stuff you want to get. Right? So there are a million different examples, but just empathetically think about yourself in the leadership role of that company and say what kind of business, what I want, and then find ways to get yourself, to get them, that business. I’m sending it out probably 400 letters a month right now. And follow up with uh, texting phone calls voicemail drops. And in that I’m not including probably 50, then I’m doing too, I’ll call them vendors. Other than that, they’re not all particularly in a pipeline per se, but I’ve spoken to me that on the phone or in person.

So I think I’m doing everything you indicate I should be, but I’m not getting a lot of traction. What market are you in? Northern Colorado. Yeah. Yeah. You’re in Laramie, weld, up that way? Yes, sir. Hang on. I coached a guy there and I thought we were getting skunked and I told him to stop buying leads and stop sending mail, but continue making phone calls.

We were at the four-month mark. He continued for two more months and he nailed six listings in one week at the six-month mark. And from there he’s held pace. Like he’s built a nice business out of there. He was a Mike Ferry guy, so he tracked every single metric. So he was a great test case for me to try to crack the code and Colorado you’re in one of the most challenging states because of the nature of how the data is recorded.

You’re getting it late. However, the ones that need your help will eventually they’ll respond to your message. The unfortunate part is your cash conversion cycle is much higher than other places in the country because they’ve been hammered by so many investors.

So I have, I’ve coached in Colorado Springs and Denver, and up in your area. All three were incredibly difficult to break into, but once we broke him, we kept the momentum and Dave Gwinn I don’t think is here today. I don’t see. There’s, there’s a face that pops up here very often, almost every week.

You’ll see a guy named Dave Gwinn. He’s down in Denver and we fought this fight probably four years ago. I think Dave started maybe five. And you might network with Dave. And there was somebody in our group and Probate Mastery Alumni looking for other members from Colorado this week. And I tagged a tagged Dave and Holly Gold was also somebody in the Denver Metro area.

But I would say if you’re following everything that we’ve talked about. And you feel like you’re done that to the best of your ability. Just be patient. If some, if the direct mail is putting budget constraints on you, pull back on the direct mail first, keep the phone calls. That seems to be the recipe in Colorado.

The other things like, so then there’s in the, in the probate mastery training course. I don’t remember which module it’s in session two. I gave you all of the letters that I’ve proven out over the years. One of those letters is called the probate social enterprise letter. Another is called a home value letter.

Both of those were written in Colorado for the Colorado Springs market. I wrote them for a broker who, a very aggressive broker who ran a call center and she just wasn’t getting traction. We shifted the letters from being very direct to be rather indirect, and we got a different result. So you might check out those two letters.

They were written for Colorado. They’ve proven out over and over in really difficult markets. The house value letter is more like a farming letter playing on the strength of the market. The social enterprise letter is kind of an introduction to the concept of your business.

Not necessarily saying, Hey, here’s what I can do for you. And on the back, it’s a two page. You flip it over. And it gives them all of their options for the real estate, starting with do nothing, put your head in the sand and lose money, hand over fist. So it’s a little bit tongue in cheek. You might want to edit it.

It’s written from my voice, but both of those worked very well. Probate social enterprise.

Okay. It’s intentionally a strange name, like most people, social enterprise doesn’t bring up anything, very familiar for most people. That’s what I want. That’s my interruptive piece. I want to interrupt. Educate, engage, ask. Right. So they’re like, oh, who does this?

Another damn realtor? What do you mean by a social enterprise? What is that, like a non-profit? And then their mind, that’s leading them deeper into my copywriting.

Okay. Okay. I appreciate that. Yeah, thanks, Bill.

Transaction Engineering: Personal Property Cleanouts

Alex Shin, you’re up? How can we help you? Yes, sir. Appreciate it. So I took the mastery course. Awesome course. Anyone who hasn’t taken the course, if they’re seeing this should take the course. I got two listings in a trust sale where the two brothers are They can’t see eye to eye on anything.

Got so bad to the point that each side has their attorneys and it’s open-litigated. There’s quite a bit of equity in the two properties, but we just finally, maybe about a year of working this, got it. To a point where now both brothers have agreed for the sale of the property and one of them, at least.

And so I took a look at one of them this past weekend, the property is in pretty decent condition. The only issue is that there’s a lot of personal property. Still in like every single room. So I just wanted to run it by you. What would be kind of the best way approach to this? Just because there’s so much tension.

I don’t want. Me the real estate guy, adding more steps to this already complicated process when there’s already a fresh wound. And also the two brothers won’t talk with each other. There’s distrust going on both sides. How do we divide up? Like who keeps this and who keeps that? And should we just do a full-on estate sale?

I used to trust Alex. So it’s again, it goes to the tr who is the trust? The, so there are two trustees, two co-trustees is the two brothers and there are also four other beneficiaries. So this is where the problem comes in. You’ve got two people trying to do one job and they don’t agree. And so here’s the, here’s what I would suggest not understanding all the legality of it or the whole history of it.

I wouldn’t sell any personal. I would go to whomever their referee, in this case, if it’s not clear to me from what I know about it, whoever that decision-maker is, I would say, listen, I’ve located a storage facility. I’ve spoken, I’ve gotten a quote from a moving company. We are going to stage this property until you guys have resolved this.

And at that time we can arrange an estate sale, but I would not recommend it. At fanning, the flames. If you saw an heirloom that you weren’t supposed to, the whole damn thing could blow up on your face, it could make the situation worse. So what I would recommend is to find a way to hire people to clean out the house, move it into a storage facility and invoice the estate.

And there should, if it’s this type of situation, I’m assuming there are enough assets there that the trustee can afford a couple of thousand dollars to keep the, keep this moving.

The referee, would that be the two attorneys on both sides? I don’t know. At this point, it may be a judge. John, who do you think is calling the shots? Well, I mean that’s yeah. Number one. There’s is there probate, is there an active probate case or is this a trust administration case? It’s not an act.

It’s not active. Okay. Yeah. Then I would litigate to get the other portraits removed. So, yeah, I mean, ultimately it’s the attorney for the trustee or whoever that is, or the two attorneys or however they see fit. I agree with what Chad said, that’s what I would do. Move the property offsite, but in a storage unit, it’s not your business or your problem, right?

I mean maybe what Chad said is we had a case. This is going back 10 plus years, Leon, my business partner had a case in Alameda county and you know, they couldn’t is the same situation that the two trustees were just fighting each other. Finally, the judge got angry and was like, I’m putting somebody else in there.

A professional fiduciary. Or some court-appointed person. And what was hilarious is that guy went in there appointed by the judge, not by us. Can’t stress. That enough I went in there, threw everything in the garbage. One of the things that made it in the trash was a signed letter to the decedent from Jackie Robinson, suggest his handwriting.

And I was like, well, Can’t stress this enough, I could not avoid this person, but if you did something in that nature, obviously you’re inviting more, you know, let the people who are lightning rods continue to be the lightning rods. That’s why you have attorneys on this case. Right. But it should be not controversial to scrape out.

I mean, if they’ve agreed to sell it and they’re ready to move forward, put it in a storage unit, get one of the pods, what are they, or they call them the pod storage unit where they come to the house and they do it for you. And then just build the estate and that. There’s no reason to, there’s no reason for you at all, to get involved with an estate sale.

I mean, you can refer them to people, but again, in this kind of lighting situation let the lightning rod do it. Don’t stand out in the rain, with an umbrella you’re going to get nailed. So let the attorneys do their job. That’s your cover? Do nothing that they don’t authorize. And just say, look, it’s got to go somewhere.

You can’t leave it here. And if you guys agree to, if you guys are agreeing to the sale, then it shouldn’t be that hard to get a stager in here. But, and on top of that, it should probably be all the personal property that gets moved to the storage unit, as opposed to letting one brother come in and take one other brother coming on.

Right? Yeah, it makes sense. And then they handle it on their own because I shouldn’t be the one involved. Yeah. What I, what I tell all my clients is if all the beneficiaries agreed they can do whatever they want when it comes to nearly anything in chest administration, especially personal property, right?

The state sale, you go first, you go second, you go third. Like if everyone agrees, they can do it. Whatever they want in a situation like this, where they can agree on the color of this. Then you need to step back and that just simply isn’t your problem. You’re going to have to let the attorneys run that and you just need to stay back because there’s nothing good that comes from that one for you.

All right. And the storage facility and moving company, have that been voiced to the state? Yeah, just get you’re going to need the authorization from the trustees to do. But that’s just you know, a credit or claim or whatever, but yeah, invoice the state, cut that so that the state’s name send that to the attorneys, have them sign off on it, or authorize it.

But that’s, like I said, get the property out of there so you can do your job, but don’t in this type of case, don’t, don’t start doing a whole bunch of other people’s jobs. Yeah, a hundred percent. If I were you, I would, I would find the facility that you want to put it in. I would probably say climate control is a safe bet, just because you don’t know everything that’s there.

To find the storage facility you’d like to use, find the labor that you would like to use and you email the two trustees’ attorneys. Not the trustee, they’re their counsel and like Cadillac, a divorce deal. This is between the professional and the attorneys. And as long as you have their authorization to do this, don’t get too, don’t get the, to fight it, the lightening or how the, as John put it, leave them the hell out of the conversation and move swiftly.

So by the time they know the house was empty, it’s all safe and stored. And the key is that the trust that the attorney’s office or wherever, wherever that ends up, I would move swiftly to keep them, you know, not to let them slip back into the quicksand. Take a leadership role here, unless the attorneys tell you to slow down, move forward with your job.

Thank you.

Yeah, it sounded like Roger, but I don’t see you. Well, something’s going on with my camera on my computer right now. So you, you, you don’t get to see my lovely face. I had a similar situation in entering the states in a state that I was working in probate. And I went to the attorney. It was one attorney and two errors that were involved.

And both of them wanted the car. One of them wanted it, the other one didn’t they wanted to go in. And I used the magic words to the attorneys’ equitable distribution. And I sit and I talked to my estate seller and I said it’s all going to go through you. It doesn’t make me the bad guy, but you can get what you want at the office.

Each one of you makes an offer on the property that you want. If one of them wants a rocking chair and what both of them want the card, both of them want the boat, whatever it is, then make an offer at the auction and they can then get a fair understanding of what they want and what is, what happens with it is reduces their price, their offer price.

At the auction. It reduces the amount of equity that they receive in the sale of the house. Because it goes into the estate and then the state, then the money is divided among the, among the estate. And it kind of takes the tension out of, I want this and you want that also. I want that chair, that bedroom suit, or whatever.

And it just basically. Puts it into how bad do you want it? And it benefits both of them because all that money goes into the estate or it reduces their take out of the estate, one of the one way or the other, but it has to be, be done in conjunction with the attorney. Or attorneys to provide an equitable quote-unquote distribution between the errors instead of a sibling rivalry over, I want that gun and you don’t, you don’t want that.

You, you can’t have that. And it’s just a matter of letting them bid on it at the auction or put in and the winner gets a raise, puts the reserve at the auction. So if it’s guns, cars, boats anything like that, just tell them, okay. Your estate seller right here, he’s going to take your bids. Before the, before the winning bid for reduction of your estate award is going to be taken out of that.

And you set a reserve on the actual auction date when it comes in. And if it goes over that they’re going to let it go. It’ll go to the highest. So it’s it takes a lot of tension out of jerking, everything out, putting it into, and a lot of expense for the, for the estate to put it into a moving company, moving company into a storage facility.

Just let them battle it out on that. But you have to get that direction from the attorney. And the estate seller and the estate seller get a commission off of that sale of the sale of that item. And he says, oh, hell yeah, it’s a $5,000 boat that a that’s in there. He’s still going to get his 20% commission off the $5,000 boat that sold because it’s done through the estate sale, it’s a lot easier.

And it was a lot easier to settle it that way. And that was at the suggestion of my estate seller to do it that way because he gets a commission. He gets a commission. Right, right. Yeah. It takes the emotion out of the process, puts it into dollars. If, how bad do you want it? You make the offer if you won’t do it.

Cause take it out of the proceeds. Completely makes sense. So, and it’s a couple of minutes, but it stays in the estate, stays in, it stays put and they have an offer and that offer is set as a reserve for that item. So if somebody comes to the auction and says, I’ll pay. Twenty-five thousand dollars for that boat.

And they’re the highest bid from the families 20,000. They’ve just enriched themselves by $5,000 in these states. That’s awesome. Thank you for sharing that. Roger. So Alex, what I would say is. Anytime you provide options, you tend to get trust faster, right. Or people will take you more seriously. So if you approach those attorneys, if you feel like it fits the situation and doesn’t risk your commission to offer that as an option like this, now they might take that as an option that may delay you getting the home on the market.

It’s if it doesn’t fit the situation, it’s a great, a great tactic that has for the future, like option a is what Roger just proposed option B would be getting everything into storage. Option C would be, you guys get the hell along like your mom and dad wanted you to, to begin with. But it’s, that’s another great area to have in your quiver.

And guys, I hate to cut us off the peak of such a good conversation, but I do have a hard stop at one that I’m late for. As always, thank you so much for entertaining a great conversation. Hopefully, you all got something actionable from this today. Thanks to everyone who contributed. John Love having you here, man.

Thanks for all your help and clarity. Thanks for letting us borrow your law degree. Again, you do so much pro bono, but guys, listen, thanks for being part of this. We’ll see you next week. Thank you, guys.

6 Comments on “How to Use the MAXIMUM ALLOWABLE OFFER Formula for Successful Wholesaling”

Hello, I enjoy reading through your posts.

I wanted to write a little comment to support you.

You really make it seem so easy with your presentation but I find this to be something that I think I would never understand.

It seems too complex and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

Its like you read my mind! You appear to know so much about this, like you wrote the book.

Good info and straight to the point. I don’t know if this is truly the best place to ask but do you guys have any ideea where to employ some professional writers? Thanks in advance 🙂

I have to express my love for your generosity for persons that actually need assistance with this one theme. Your personal commitment to passing the message up and down had become astonishingly invaluable and have truly empowered others much like me to reach their endeavors. Your personal informative instruction means much to me and even more to my colleagues. Many thanks; from all of us.

SEE ALSO:

1) Presenting price options to sellers using the seller net sheet discussed in the Probate Mastery course: https://www.youtube.com/watch?v=cuCLRnhtXGM&t=541s

2) Tying together cost calculations and presenting price offers: https://youtu.be/5IPg3A5CXFU