How would you start investing in real estate today if you could choose any strategy or asset class? Here is my 7-day play to get started real estate investing if I had to start all over today:

View the Thread on Twitter

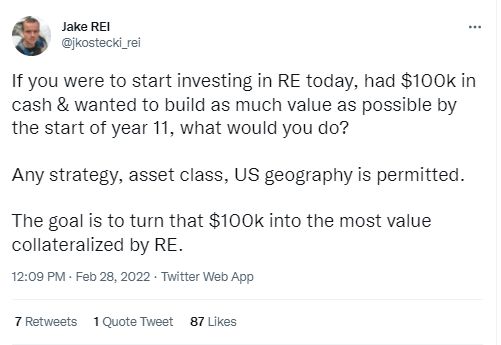

Jake Kostecki posed a great thought experiment on Twitter asking what people would do if they had $100k in cash to start investing in real estate today.

Day 1

$25.5k: Establish LLC, Obtain EIN, drive to a community bank to deposit $25k in a business checking account and immediately request a conversation with the VP of Commercial Lending to establish a DSCR lending strategy I can trust for BRRRR

Day 2

$5k: Obtain probate list, pre-foreclosure/NOD list, vacant with marginal equity list, and vacant with slight negative equity list, write specific “we are a social enterprise with the solution to your problem” letters, send to print shop for fulfillment.

Day 3

$0: Get to know the wholesalers…Visit REI meeting, put out FSBO distressed seller post on FB and Craigslist, google “we buy houses”

Day 4

$1,000: Set up a MeetUp for all the wholesalers you found and invite them to a learning-dinner in a banquet room where you share a course you bought (this will be a course that you paid for but will help them get more deals)

Day 5

$30 in gas and lunch: Today you should have houses to look at and offers to make. Considering the lists you’re targeting and the wholesaler relationships you should have a mix of opportunities ranging from cash acquisition to no-money-down creative strategies, to low-money-down sub-to deals.

Day 6

Call the VP at the community bank and run the deals by him/her that you have under contract and start the refi discussion on the first house.

Day 7

$175: BBQ & Beers for everyone you met this week that helped you get your low-money-down (less than $32k) strategy in place in less than a week.

Week 2 and Beyond:

You have $69k in reserves for repairs, rental advertising, etc. so you can get that first house renovated (if necessary), get a tenant in place, deliver the lease and background check in-person to your new banker and even if they won’t start the refi until you have 2 mo. rent collection he at least sees how you take action and expect him to as well.

Now it’s your turn: How would you get started in real estate investing in this example? Share in the comments below or jump to the Twitter Thread